Looking Back at 2024: The Year Crypto Raced Ahead 🚀

If 2023 was the year of recovery, 2024 was the year of acceleration. Markets surged, records were broken, and competition in the crypto space intensified. But in a year where the total crypto market cap nearly doubled, not all projects could keep up.

Some tokens soared to new heights, outpacing even Bitcoin, while others struggled to hold their ground. With 2025 already underway, it's time to break down the biggest winners, the hardest falls, and the lessons learned from a year of explosive movement.

🔝 Bitcoin, Ethereum, and Tether: Still on Top, But for How Long?

Bitcoin, Ethereum, and Tether remained the top three cryptocurrencies by market cap in 2024, though not all held their ground unchallenged. Bitcoin hit new all-time highs 💰 , but several other tokens delivered even steeper gains, intensifying competition across the broader crypto landscape.

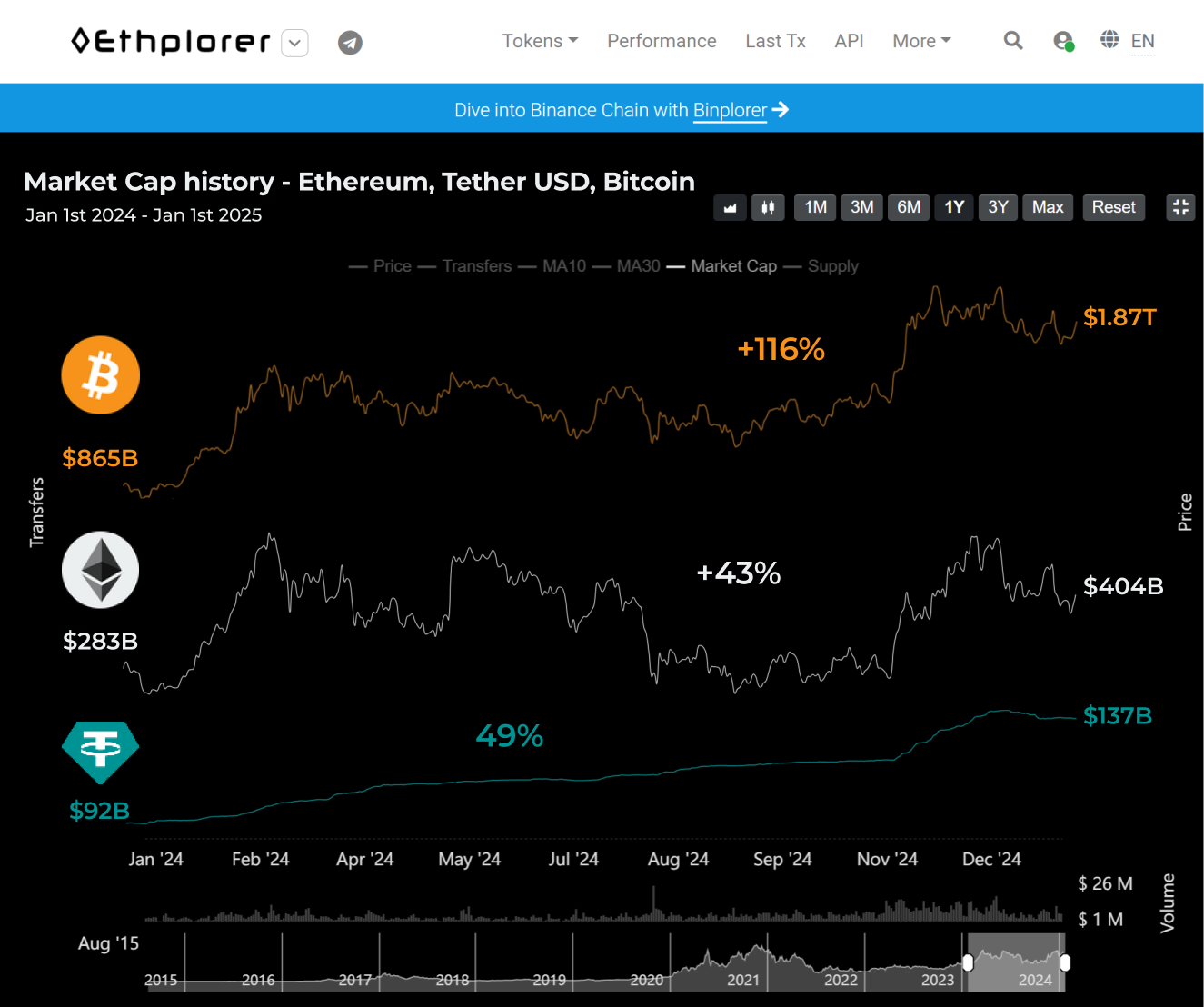

Bitcoin (BTC):

Bitcoin had a record-breaking year, smashing through the $100,000 barrier for the first time. It peaked just above $108,000 on December 17 before closing the year at $94,419, marking a 114% price increase from Jan 1, 2024, to Jan 1, 2025. Its market cap surged +116%, growing from $865 billion to $1.87 trillion. Trading volumes followed suit, jumping 115% (in $) compared to 2023, a sign of sustained liquidity and investor demand. As capital flowed back into BTC, its market dominance surged from 47.99% to 54.47%, further widening the gap between Bitcoin and the rest of the market.

Ethereum (ETH):

Ethereum’s performance wasn’t as dramatic, but it made significant strides in scalability and efficiency. Its price climbed from $2,352 to $3,353 (+42%), with its market cap reaching $404 billion (+43%). Trading volume surged 162%, driven by major upgrades like Dencun and EIP-4844, which reduced transaction costs and improved throughput. The expansion of Layer-2 solutions further eased congestion, reinforcing Ethereum’s role as the backbone of decentralized applications.

Tether (USDT):

Tether did what it does best: stay pegged to $1. But behind the stability, its market cap grew by 49% to $137 billion, proving that demand for stablecoins remains high. Though 2025 began with USDT in the top 3, it was overtaken by XRP soon after.

⚡️ XRP:

Rising from outside the top three, XRP surged 269% in price, climbing from $0.63 to $2.32, while its market cap soared 291% to reach $133 billion in 2025. Its rise was fueled by regulatory optimism, as the election of Donald Trump revived hopes for a friendlier stance on crypto, particularly regarding Ripple’s legal battle with the SEC. Ongoing speculation around XRP-based financial products and Ripple’s stablecoin plans further boosted investor confidence, ultimately pushing XRP past USDT into the top three.

The Biggest Gainers of 2024: Altcoins and Meme Coins Take the Spotlight 📈

Bitcoin’s surge past $100,000 was historic, but in terms of percentage gains, it was far from the year's biggest winner. Several altcoins and meme coins delivered far more dramatic returns, with some gaining more than 1,000% over the course of 2024.

- Bitget Token (BGB) led the charge, skyrocketing by 891% from $0.60 to $5.91. The utility token of the Bitget centralized exchange wasn’t just about price growth—it saw a 1,316% increase in market cap.

- Sui (SUI), a high-performance Layer-1 blockchain, followed closely. As more projects launched on Sui, its native token surged from $0.84 to $4.28 (+407%), with its market cap growing by 1,287%.

- Pepe (PEPE) proved once again that meme coins can’t be ignored, delivering an astonishing 1,277% price increase. The token, inspired by the “Pepe the Frog” meme, climbed from $0.0000014 to $0.0000194, with a 1,282% surge in market cap. It became a favorite among speculative traders, and its rapid ascent was closely tracked on Ethplorer’s charts, where its price and market cap gains were reflected in real time as it climbed the ranks. You can check out its live performance here:Pepe on Ethplorer.

- Other notable gainers included Hedera (HBAR) (+265%) and Stellar (XLM) (+244%) in market cap, as institutional adoption and blockchain partnerships fueled renewed investor interest.

The Biggest Declines of 2024: Projects That Couldn’t Keep Up 📉

-

Polygon (MATIC), one of the leading Layer-2 solution for Ethereum, struggled throughout the year. Its price dropped from $1.02 to $0.47 (-53%), while its market cap plummeted by 91%, marking one of the most dramatic declines among leading blockchain networks.

-

Cosmos (ATOM), known for its focus on blockchain interoperability, also took a hit. Its price fell from $11.20 to $6.52 (-42%), accompanied by a 40% decline in market cap, reflecting investor skepticism despite the network’s continued technical advancements.

-

Injective (INJ), a project specializing in decentralized finance, faced a steep correction. Its price dropped from $39.65 to $20.51 (-48%), while its market cap fell by 39%, showing that even DeFi-focused projects weren’t immune to shifting market conditions.

-

Other notable declines included Optimism (OP) (-55%) and Filecoin (FIL) (-33%), both of which saw considerable losses in price.

And then there’s Bitcoin Cash (BCH)—a project that, despite everything, refuses to go quietly.

After enduring a halving event, miner sell-offs, volatility, rising competition, and the tax scandal of its most famous advocate, Roger Ver, you’d think BCH would be on the verge of extinction. But somehow, against all odds, it still posted a respectable 70% growth in market cap.

That might sound impressive—until you consider that the entire crypto market grew by 97.15% and trading volume surged by 142.31% over the same period- according to CoinGecko. For a token that has spent years battling for its place, BCH’s 2024 performance was less of a comeback and more of a desperate sprint just to hold its ground, ending the year exactly where it started at #20th place by market cap.

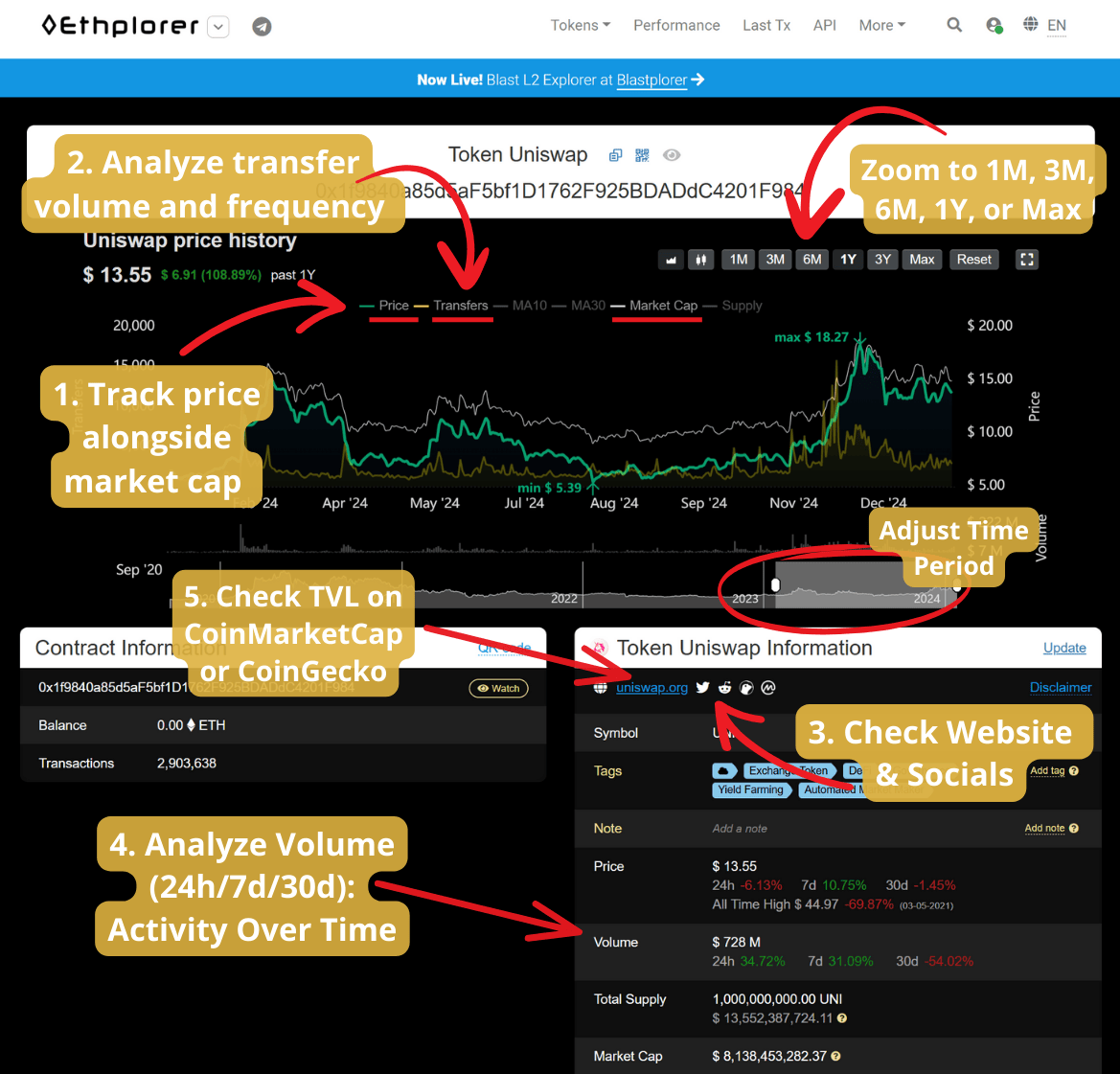

🔍 How to Quickly Analyze a Blockchain Project’s Growth

Market cap is often the first metric investors check, but it only tells part of the story. A token may appear valuable on paper, but is it being used? Here’s how to go beyond market cap and perform a quick yet effective analysis.

Why Market Cap Alone Isn’t Enough

- Supply vs. Demand Imbalance ⚖️– A high market cap can sometimes be misleading. Inflated token supplies may make a project appear valuable even if real demand or adoption is low.

- Centralization Risk 🔐– If most tokens are concentrated in a few wallets, manipulation becomes a real concern.

Five Key Metrics to Watch

-

Price Trends – A stable or growing price reflects confidence. Tracking price alongside market cap on Ethplorer helps determine whether growth is backed by consistent activity.

-

Transfers – High transfer activity often signals a thriving ecosystem. On Ethplorer, analyze transfer volume and frequency to gauge user engagement and token usage.

-

Community & Development – A project’s website, social media, and developer activity reveal a lot. Check the Information section on Ethplorer to find direct links to project resources. Go directly to the project's Discord, Telegram, or Twitter—look beyond just follower counts and check how active the community is and what people are saying. Engagement matters more than numbers.

-

Volume – High trading volume reflects liquidity, but sudden spikes can signal manipulation. Ethplorer’s Volume (24h/7d/30d) data, found in the Information section, breaks down trading patterns over different timeframes.

-

TVL for a Deeper Look – Total Value Locked (TVL) indicates trust in a project’s ecosystem. For larger investment decisions, checking TVL on CoinMarketCap or CoinGecko can provide additional insights.

🚨 Final Reminder:

Even strong technical indicators don’t guarantee legitimacy. Verify sources, team activity, and real-world adoption to avoid falling for hype-driven projects.

📊 The Next Big Shift Is Always Around the Corner—Be Ready with Ethplorer

As we move further into 2025, staying ahead means having the right tools to track market trends and spot real opportunities. Ethplorer makes it easy with clear, easy-to-read charts, insights into publicly available entity addresses, the Watching Service for real-time transaction alerts, and more.

Whether you need a quick market scan or deeper analysis, you’ll find everything you need here. Learn more about it here.